There is more bad news for Hidden Valley gold miner, Harmony Gold, on the back of its pollution of the Watut River in Papua New Guinea, Ramu Nickel Mine Watch reports.

Fitch Ratings Ltd has announced that it has lowered Harmony Gold’s credit ratings over concern its shrinking cash levels and higher costs will prompt it to increase debt or sell shares.

|

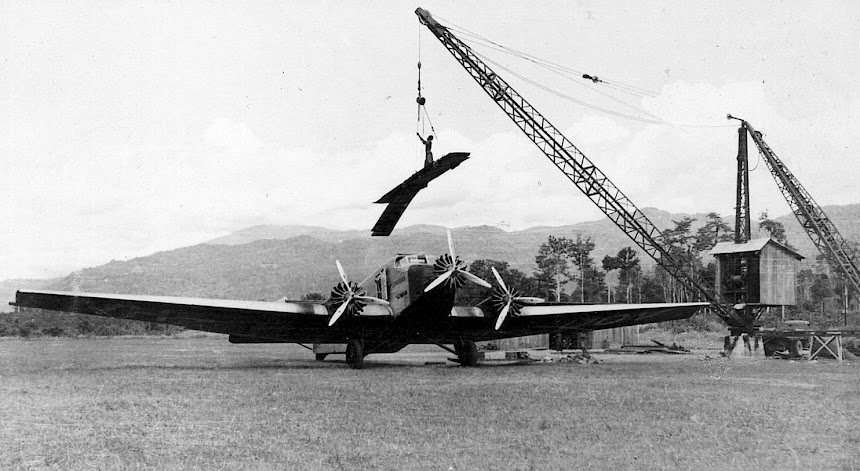

| Vegetation die-back along the Watut river caused by pollution from the Hidden Valley mine could cost Harmony dearly |

“The company will need to raise additional equity or debt to finance its future expansionary investment.”

Fitch lowered the long-term foreign-currency issuer default rating to BB- from BB with a negative outlook. The national long-term rating was cut to BB- from BBB-, also with a negative outlook, and the short-term to B from F3.

Harmony is facing the prospect of a major compensation claim from landowners affected by the sedimentation and poisoning of the Watut river by the Hidden Valley mine, which it jointly owns with Australian company Newscrest.

Harmony is also closing some South African shafts as costs rise, ore becomes depleted and the rand’s gain counters the benefit of record dollar prices for gold.

Bloomberg news says Harmony spokeswomen Marian van der Walt said of the credit rating drop “It’s disappointing but they apply their own variables. We’ve positioned the company to deliver on what we’ve promised.”

Harmony’s cash and cash equivalents fell to 770 million rand ($111 million) by the June 30 end of the fiscal year, from 1.95 billion rand a year earlier

No comments:

Post a Comment